FXTM Cashback offers traders a powerful way to cut down on trading costs and boost overall profitability. By returning a portion of the spread or commission on every eligible trade, this rebate program has become a favorite among active forex traders looking for smarter ways to maximize their returns.

Whether you’re a beginner or a seasoned trader, understanding how FXTM Cashback works can help you make the most of every trade. In this guide, Backcom breaks down everything you need to know — from activation steps to eligible accounts and trading strategies.

Contents:

What is FXTM Cashback and How Does It Work?

FXTM Cashback is a rebate program offered by ForexTime (FXTM), allowing traders to earn back a portion of the spread or commission on eligible trades. This cashback serves as a reward mechanism and can help reduce trading costs over time. Rather than a one-time bonus, cashback is paid continuously based on trading volume, encouraging long-term engagement and higher-frequency trading.

FXTM calculates rebates based on specific criteria, typically the number of lots traded and the account type. The cashback is either credited directly to the trading account or through an Introducing Broker (IB), depending on how the trader enrolled in the program. Some campaigns may offer up to $5 per lot, although actual rates vary.

Now that you have a clear understanding of how FXTM Cashback functions, it’s important to consider its credibility. Let’s explore whether FXTM Cashback is truly legitimate and safe for traders.

How Can You Claim or Activate FXTM Cashback?

There are typically two main ways to activate FXTM Cashback, both of which begin with the FXTM cashback registration process to ensure your account is eligible for receiving rebates.

Direct from FXTM (if available in your region)

- Register or log in to your MyFXTM account.

- Navigate to the “Promotions” section.

- Select the Cashback campaign and click “Join Now”.

- Fulfill the minimum deposit and trading volume requirements as specified.

Via a Reputable Introducing Broker (IB)

- Open an FXTM trading account using the IB’s referral link.

- Confirm that the IB offers a cashback arrangement.

- The IB may handle the tracking and payment of cashback, either daily or weekly.

- You may need to trade a minimum number of lots to qualify.

Rebates typically start accumulating after your first trade and are credited according to the cashback schedule (daily, weekly, or monthly).

Advantages and Disadvantages of FXTM Rebate Program

Rebates can reduce overall trading costs and improve profitability, but the program also comes with certain conditions that every trader needs to understand. Below is a balanced overview:

Advantages

- Reduced Trading Costs: The primary benefit of the FXTM rebate program is the direct reduction in trading expenses. By receiving cashback on each trade, whether profitable or not, traders can offset spreads or commission fees, leading to improved cost efficiency.

- Daily or Regular Payouts: Many rebate structures allow clients to receive payouts on a daily or periodic basis. This provides consistent returns that can be withdrawn or reused for trading, enhancing cash flow flexibility.

- Accessibility Across Accounts: The rebate program is available for various account types (e.g., Standard, ECN, Cent), which means both beginners and professional traders can benefit.

- Partnership Opportunities: Through IB (Introducing Broker) connections, traders can join rebate-sharing schemes, enabling them to maximize rewards while still trading under FXTM’s regulated environment.

- Motivation for Consistent Trading: Receiving cashback even on losing trades can serve as an incentive for maintaining trading activity, especially for high-frequency or volume traders.

Disadvantages

- Eligibility Restrictions: Not all accounts or instruments are eligible for rebates. For example, promotional bonuses or specific asset classes may be excluded, limiting the potential benefits.

- Dependence on IB Relationship: In most cases, rebates are tied to the IB you register under. If the IB does not share rebates or provides only partial cashback, your benefit may be smaller than expected.

- Conditional Withdrawal: Some rebates may be subject to minimum trading volume, holding periods, or verification requirements before withdrawal is allowed. This adds complexity compared to direct trading profits.

The FXTM rebate program is a powerful cost-saving mechanism for active traders, particularly those trading larger volumes. However, to maximize benefits, traders must register under a reputable IB, understand the program’s conditions, and ensure that their trading habits remain consistent with sound risk management practices.

Once your cashback is successfully activated, the next logical step is to understand how FXTM calculates the cashback you’ll receive.

How Is FXTM Cashback Calculated?

FXTM cashback is typically calculated based on either lot-based rebates or through the FXTM Loyalty Program, depending on the promotional campaign or the IB you register under. The FXTM cashback calculation method is generally consistent with the industry standard, ensuring transparency and predictability in your rebate earnings.

Cashback Calculation Formula

Cashback = Traded Lots × Rebate Rate (USD per lot)

Where:

- Traded Lots refers to the number of standard lots you trade (1 standard lot = 100,000 units of the base currency).

- Rebate Rate depends on the promotion or the IB. It may vary by account type or asset class.

Example:

If a trader executes 50 lots on a Standard account under an IB offering $5 per lot, the cashback is:

50 lots × $5 = $250

Cashback via FXTM Loyalty Program

The FXTM Loyalty Program, historically available to selected clients, offers tiered cashback as clients reach specific milestones based on:

- Trading volume

- Deposit size

- Number of completed trades

The program divides traders into loyalty levels (e.g., Blue, Silver, Gold, Diamond), each with progressively higher rebate rates.

Key Conditions That Affect Cashback Eligibility

- Minimum trade duration: Some rebates are only credited for trades open longer than 3 minutes.

- Minimum trading volume: Many promotions require a monthly threshold (e.g., 10 lots).

- Account types: Only selected accounts (see below) are eligible.

Knowing how your rebates are calculated helps you estimate potential returns. But first, make sure your FXTM account type is eligible to receive cashback.

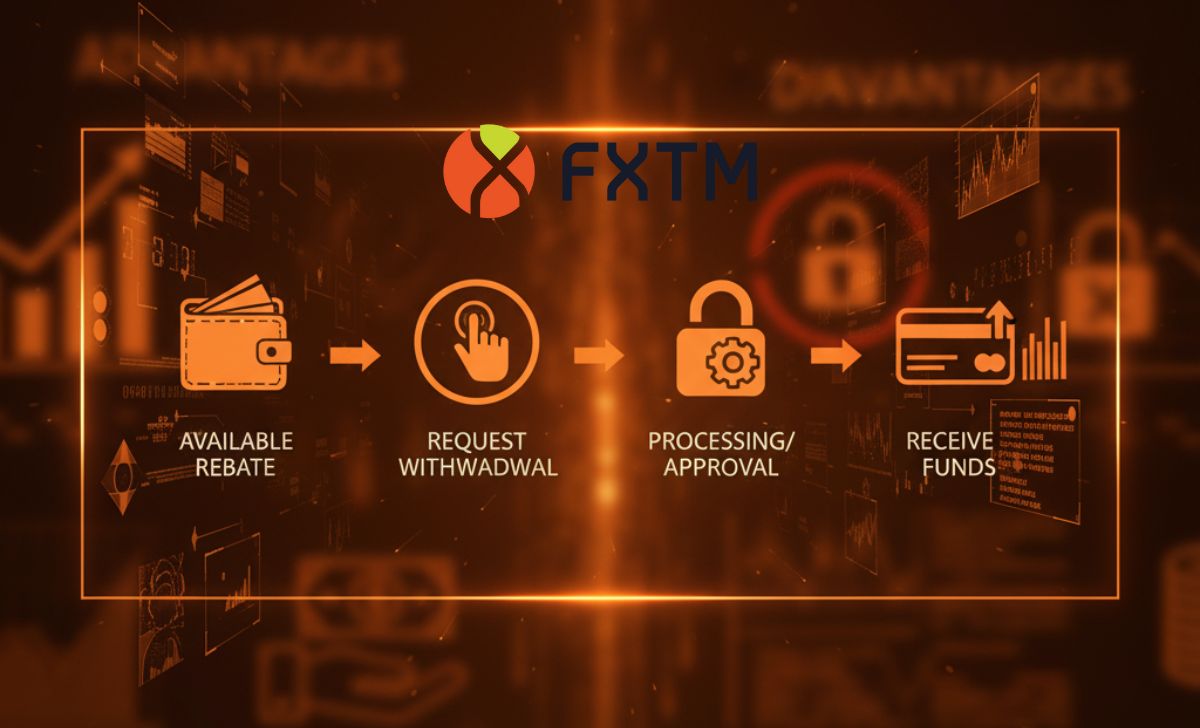

How to Withdraw Rebate FXTM: A Step-by-Step Guide

First, it’s essential to recognize that rebates from FXTM are distinct from trading bonuses: rebates are earned based on actual trading volume or via an IB (Introducing Broker) scheme, and under proper conditions, they become withdrawable funds.

Now, here’s how you withdraw your FXTM rebate in practice:

Log into Your MyFXTM Account

- Begin by accessing your FXTM client portal via your registered credentials (email + password). This is your main dashboard for rebates, trading, deposits, and withdrawals.

- Locate the “My Rebate” or “My Cashback” Section: Inside the dashboard, find the section labeled My Rebate, My Cashback, or Rebate/Rewards. Here, you can see how much rebate you’ve accumulated and whether it’s “available for withdrawal” or still “locked/pending.”

Check Withdrawal Eligibility

Before attempting to withdraw, confirm that your rebate meets all eligibility criteria. Common requirements include:

- The rebate must be marked as “withdrawable” (i.e. not locked or under holding period).

- Your account must be fully verified (KYC – identity and address).

- You must satisfy the minimum trading volume or lot threshold defined by the rebate program.

- The rebate must not be part of an expired promotion or subject to policy violations.

If any condition is unmet, the system often restricts withdrawal until compliance is achieved.

Submit a Withdrawal Request

Once eligibility is confirmed:

- Go to the Withdraw Funds page in your FXTM portal.

- Choose the payment method you prefer — e.g. bank transfer, e-wallet, etc. In some cases, you may need to use the same method used for deposit (depending on FXTM’s internal rules).

- Enter the amount of the rebate you want to withdraw (within allowable limits).

Confirm the Transaction

Due to security protocols, the platform may ask you to confirm via email, SMS code, or other verification steps. This is to ensure the withdrawal request is legitimate.

After submission and confirmation, FXTM processes the withdrawal. In many cases, the request is handled within 24 business hours, though actual timing may vary depending on your withdrawal method and region.

Eligible FXTM Accounts for Cashback

FXTM has a range of account types, but only specific ones typically qualify for cashback or rebate programs.

Commonly Eligible Accounts

- Cent Account – Often included in IB-based cashback offers for new traders.

- Standard Account – A popular choice with many rebate programs from IB partners.

- Advantage Account – Formerly known as ECN accounts, this type may be eligible for cashback but often at a lower rate due to lower spread costs.

- Advantage Plus – Occasionally included in promotions depending on the region and IB partner.

Cashback may not be available for demo accounts, swap-free accounts (in some regions), or accounts with bonus credits.

How to Check Eligibility

- Contact your IB partner or FXTM Account Manager.

- Visit your FXTM dashboard to see if you’re enrolled in the Loyalty Program.

- Ask FXTM support: “Is my account eligible for cashback or rebate offers?”

Only certain account types support cashback benefits, so choosing the right one is key. Next, we’ll address a common concern: Is FXTM cashback legitimate and safe to use?

Is FXTM Cashback Legitimate and Safe?

Yes, FXTM Cashback is legitimate and safe. FXTM is a globally recognized forex broker, regulated by several tier-1 and tier-2 authorities:

- CySEC (Cyprus Securities and Exchange Commission) – License No. 185/12

- FCA (UK Financial Conduct Authority) – Reference No. 777911

- FSCA (Financial Sector Conduct Authority) South Africa – FSP No. 46614

- FSC Mauritius – Global Business License No. C113012295

These licenses require FXTM to adhere to strict compliance standards, ensuring transparency and fairness in promotional programs like cashback. In addition, FXTM separates client funds from operational funds, providing an additional layer of safety.

With its security and reliability confirmed, the next step is identifying which types of FXTM accounts are eligible to receive cashback.

What Types of FXTM Accounts Qualify for Cashback?

FXTM offers several account types, but cashback eligibility is generally limited to specific ones. As of the most recent update, the following accounts commonly qualify for cashback:

- Standard Account

- Cent Account

- Advantage Account (in select regions or under certain IB programs)

Notably, Advantage Plus and ECN Zero accounts may not always be included in cashback programs unless the promotion explicitly states so. Cashback terms can also depend on how the account was opened (directly or through a rebate provider/IB).

Each eligible account must meet minimum trading activity criteria (e.g., 1 standard lot traded) for the cashback to apply. It’s important to read the terms of any campaign or confirm with FXTM support or your IB.

Knowing the eligible account types helps you set up your trading correctly. Let’s move on to learn how you can actually claim or activate your FXTM Cashback.

Where Is FXTM Cashback Available and Who Can Access It?

FXTM Cashback is available in most countries where the broker operates, with certain regional limitations due to regulatory restrictions. Countries eligible for cashback promotions include:

- Nigeria

- Malaysia

- Indonesia

- Pakistan

- Vietnam

- South Africa

- Some LATAM regions

However, due to ESMA regulations, residents in the European Economic Area (EEA) may not be eligible for incentive-based promotions, including cashback. Traders are advised to verify their region’s eligibility by contacting FXTM support or their IB.

FXTM cashback is offered in various countries but may have specific eligibility requirements. To determine whether FXTM gives you the best value, let’s compare it against other brokers’ rebate programs.

Comparing FXTM Cashback with Other Brokers

FXTM’s cashback programs, while competitive, differ in structure compared to those from other major forex brokers. Here’s how FXTM stacks up:

| Broker | Rebate per Lot | Cashback Source | Program Type | Notes |

| FXTM | $3–$5 | IB or Loyalty Program | Manual/Seasonal | Varies by IB, not always public |

| Exness | $3–$5 | IB-based only | Consistent | Transparent via Exness Partner Portal |

| IC Markets | $1.50–$2 | Rebate Services & IBs | Weekly/Biweekly | Lower due to raw spread accounts |

| FBS | $5–$15 | Built-in Cashback Program | Permanent | Weekly payout, automatic tracking |

| XM | $3–$7 | Loyalty & IB | Tiered | Redeemable as cash or bonus credit |

Observations:

- FXTM cashback is often competitive when linked through IBs but less transparent compared to brokers like Exness or FBS, which display cashback levels openly.

- Flexibility: FXTM cashback is often customized by IBs, offering better rates for high-volume traders.

- Credibility: FXTM’s regulation by CySEC, FCA, and FSCA provides additional assurance for rebate fulfillment when compared to offshore brokers.

FXTM’s rebate rates and structure may offer competitive advantages, depending on your trading style.

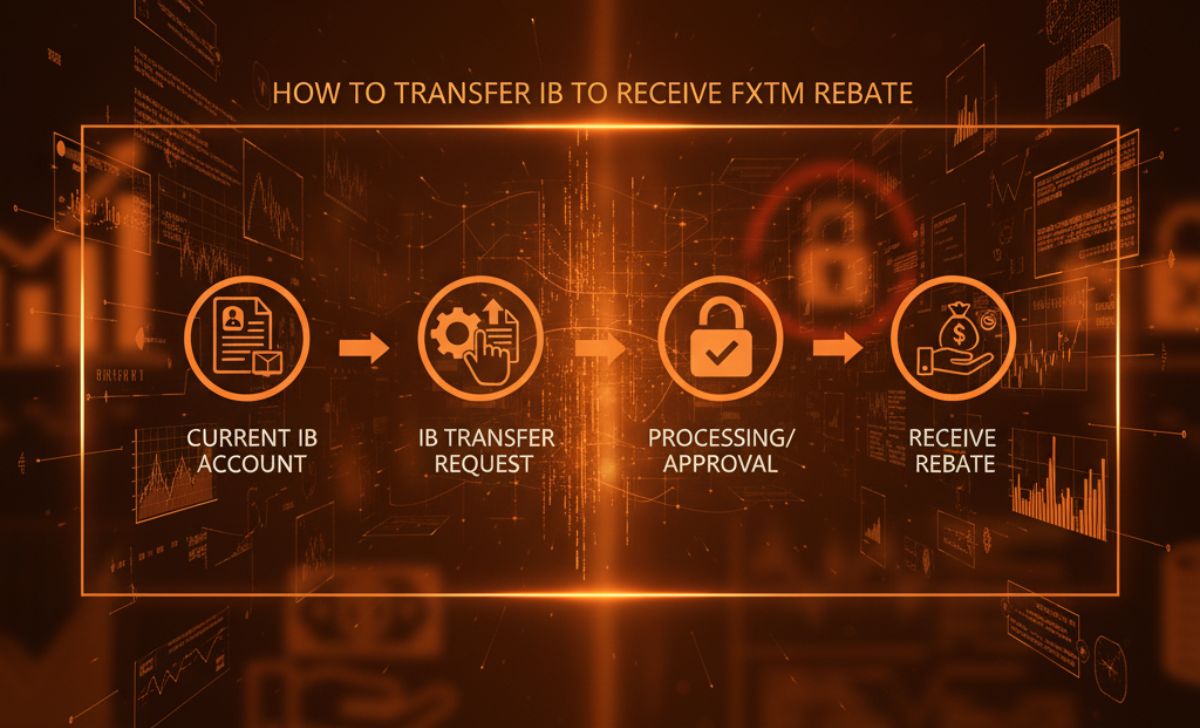

How to Transfer IB to Receive FXTM Rebate

If your current IB doesn’t offer or share rebates, switching to one that does can unlock that benefit. But the transfer must follow FXTM’s policy to ensure legitimacy and avoid violations. Here’s the step-by-step method to transfer your IB code:

Step 1: Contact FXTM Support or Your Account Manager

You cannot always self-edit the IB code; for many users, the change request must go through FXTM’s support team or account manager. Submit a ticket or start a chat and clearly state your intention to transfer IB to receive rebate benefits.

Be ready to provide:

- Your FXTM account number

- The new IB code you wish to use

- A valid reason for the change (e.g. you missed adding the IB code during registration, or your previous IB relationship is inactive)

Step 2: Ensure Eligibility & Compliance

Not all accounts qualify for an IB change. Key conditions often include:

- No prior trading history: If you’ve already executed trades, the request may be denied.

- Time window constraint: Some sources say FXTM allows IB changes within 72 hours of registration via profile settings. After that, direct change via support may be required or refused.

- The change request should align with FXTM’s internal compliance checks.

If your account doesn’t satisfy these, your request may be rejected.

Step 3: Verification & Review by FXTM

Once submitted, FXTM will review your request. They will validate the account’s status, check for prior trades or violations, and confirm the integrity of the request. This can take 1 to 3 business days.

If all is satisfactory, FXTM will approve and update your IB code. You’ll receive notification (often via email) once the change is complete.

Step 4: Confirm Rebate Activation

After the IB code is successfully changed:

- Check that your account is now linked to the new IB partner that offers rebate sharing.

- Verify that your rebate tracking dashboard or “My Rebate” section reflects the new IB affiliation.

- Understand that past trades or rebate earnings under the old IB are usually not retroactively transferred; the new rebate applies only to future trading volume.

Now, let’s explore how cashback can actually influence your trading strategy.

How Can FXTM Cashback Affect Your Trading Strategy?

FXTM Cashback can positively influence your trading strategy in several ways:

- Reduced Trading Costs: By lowering effective spreads or commissions, cashback increases your net returns per trade.

- Encourages Higher Volume: Traders may aim to meet the minimum lot requirements, potentially increasing market participation.

- Strategic Scaling: High-frequency or scalping traders can particularly benefit from rebates, as even small profits per trade compound over many trades.

However, traders should avoid overtrading just to earn cashback. Trading volume should align with a well-tested strategy and proper risk management. Cashback is a supplement, not a substitute for solid trading discipline.

Understanding its strategic value can help you trade smarter. Finally, let’s answer some of the most frequently asked questions about FXTM Cashback to ensure you’re fully informed.

What Common Questions Do Traders Have About FXTM Cashback?

Here are answers to frequently asked questions:

How much can I earn from FXTM Cashback?

- It varies. Most rebate programs offer between $1 to $5 per lot, depending on your account type, trading volume, and the terms of the campaign.

Is the cashback withdrawable?

- Yes, once credited, cashback is usually fully withdrawable and treated as real funds unless otherwise stated in promotional conditions.

Can I combine FXTM Cashback with other promotions?

- In most cases, no. Cashback campaigns may not be stackable with other bonuses or offers unless FXTM explicitly permits it.

What happens if I stop trading?

- If no eligible trades are executed, cashback will pause. Some programs may require ongoing activity or monthly volume to maintain eligibility.

Can demo accounts earn cashback?

- No, only live, funded accounts are eligible for cashback rebates.

Conclusion

FXTM Cashback is a strategic tool for reducing trading costs and enhancing profit margins, especially for active traders. Whether you enroll through FXTM directly or via a trusted IB, it’s crucial to understand the terms, maintain consistent trading activity, and align your strategy to maximize benefits. By joining the FXTM Cashback program, traders can also tap into broader forex cashback opportunities that provide extra value with every trade. Don’t miss out on the chance to boost your profits—start enjoying FXTM Cashback and reliable forex cashback rewards today.

Post Date: 24/11/2025

Niko Varrin is a product strategist and UX designer from the Netherlands with more than 7 years of experience in blockchain startups. At Backcom.app, he oversees product vision, platform design, and user experience. Niko’s goal is to deliver a smooth, transparent, and scalable cashback tracking interface for traders across all supported exchanges. Email: [email protected]

Tiếng Việt

Tiếng Việt